Planning ahead

As your dementia progresses, you may no longer be able to make decisions on your own. It might be hard to think about, but by planning ahead and communicating your decisions, you can make sure your wishes are respected.

Transcript

[Beginning of recorded material]

Dr Dimity: Well, planning ahead actually covers a whole range of things more than we normally think about. Of course,

there's the will, and there's also planning ahead for financial matters. Appointing a financial power of attorney, but there's also

appointing a substitute decision maker to cover lifestyle issues and medical decisions. And that's very important for all of us,

actually. And in addition to that, I think it's important to discuss with family, carers, and health professionals about what your

values are.

Kathy: Well, initially, it wasn't so much health care decisions, it was more about where she was going to live and, I guess,

even just simple things like I knew she hated her hair being flat at the back and going grey – so I made sure she had her hair

cut and coloured before it got grey, and I knew that was really important to her. And when she was able to have some sense

of that, even beyond, when she couldn't really make her own decisions or really have a sense of her hair, I still kept it up

because I knew that's what she would have wanted.

Other things like what she would wear, I knew she didn't want to be in tracksuits all day so I gave clear instructions to the nursing home to make sure that she was in clothes that she liked, where it was bright like she would always wear. So, trying to make sure that her life continued when others might be making decisions for her, when I might be making decisions that was similar to what she would have done herself. Even things like she loved looking out of her lounge window at trees when she lived at home, so I tried to make sure that that was still the case when she moved into care.

Imelda: Being in the nursing home, there were lots of decisions I had to make with all sorts of facets of his care right through to the end-of-life process where, again, thankfully, the doctor referred to his advanced care plan, so that was quite heartening to know that we were actually able to say, “Yes, I want you to do that because that was his wishes”. And then, of course, right through to the end of life and his death. So, all of those, there were many, many major steps which were, in a sense, made easier because I knew I had a document that said he trusted me to make these decisions for him.

[Title card]

This project was funded by the National Health and Medical Research Council’s (NHMRC) Cognitive Decline Partnership Centre (CDPC).

We would like to thank the video participants:

Imelda Gilmore – CDPC Consumer Network

Dr Dimity Pond – General Practitioner

Kathy Williams – Former Carer.

Originally published in March, 2017.

[End of Title card]

[Title card]

Dementia Australia logo

1800 100 500

dementia.org.au

[End of Title card]

[END of recorded material]

Planning ahead gives your loved ones the information they need to make difficult decisions on your behalf. And it means you can feel confident that the decisions other people make for you, like agreeing to different treatments or care, are those you would choose for yourself.

It’s something that can provide immense peace of mind for you and your loved ones. These are some useful steps and documents as you plan for your future.

Plans you might need to make

Realistically, “planning ahead” can be anything you want it to be. But there are some important decisions you should consider and communicate as soon as you feel ready:

Finances

Consider how you can set up your finances to run smoothly in the future. If you have a partner, are they a joint signatory on all your accounts? Can someone else make enquiries on your behalf at the bank or Centrelink? Are all your financial documents — your mortgage, insurance policies and superannuation — up-to-date and easy to find? Have you spoken to a financial adviser to plan for your future needs?

Legal matters

Think about whether you want to make any changes to your will. Is your will up-to-date? Is it easy to find?

Medical care

Work through your preferences for medical care and treatments, including end-of-life planning.

Work

If you’re still working, plan out what you want to do. Do you want to continue working, or finish up? If you want to stay, how can you make it more manageable? Our Work and dementia page has advice and guidance.

Care arrangements

Think about the kind of care and assistance you might want in the future. For example, do you want to stay at home as long as you can? Can you live with a family member? Or will you move to residential care? Our Care Options pages have more information.

Decision-makers

Consider who you want to make financial, healthcare and lifestyle decisions on your behalf. This person (or people) is often referred to as a substitute decision-maker. Our Deciding who can speak for you page provides guidance on choosing a decision-maker.

Talk these decisions through with people you trust: family, a close friend, or a legal or financial adviser. Talk to your doctor about medical decisions, as they’ll have a good understanding of your health and can help co-ordinate your care.

Our expert webinar on capacity and decision-making can help you understand your choices and how to make them.

Transcript

[Beginning of recorded material]

[Title card: Dementia Australia]

[Title card: Understanding Capacity and Decision Making]

Margaret: Welcome, everyone! Welcome to our webinar on Understanding Capacity and Decision making. My name's Margaret Crothers, and I'm the manager of Advocacy and Regional Services at Seniors Rights Service, and with me is Halil Ozbetazli, who is an Aged Care Advocate at Seniors Rights Service. And we are here to present this information to you today. Let's begin by acknowledging the traditional custodians of the land on which we all live, and pay our respects to the Elders past, present, and emerging. So, let's get underway.

I suppose the best way to start is to think about capacity, because that's our first question, isn't it? Understanding capacity. If we look at it, there's no real single definition of capacity. It's not just that simple, it's not just that black and white. It really depends on the decisions that are being made. So, I think we'll just work from this simple overview. You are capable of making decisions if, number one, you understand the facts and choices involved. Number two, you understand how the choices affect you. And finally, that you can tell someone what your choice is. And this is an important thing. If you are able to communicate your choices, then of course you have the ability to provide that information and you have that ability to make that decision. Supported decision making is very simply just helping another person make choices. So that's another part of our talk today, understanding capacity and understanding supported decision making.

The other person helping you make choices doesn't have to be an enduring guardian or power of attorney. Sometimes, there are legal restrictions and you will have to have an enduring guardian or a power of attorney sign some documents, but it can, in general, just be a representative, just someone that you choose. For example, if you are entering an Aged Care home and you can't sign the contract or the agreement, you can ask a representative to sign it for you. So when we're talking about supported decision making, we are just simply talking about someone who is helping you to make those choices.

So how does it work? Well, very simply, that person who is helping you to make those decisions is going to be by your side. They're going to be listening to you, they're going to be listening to what's important to you, and they're going to be listening to what you want. And then probably the most important role that they have is helping others understand what you want. I'm going to ask my colleague, Halil, who is a very experienced aged care advocate to give an example and some case studies of the various points that I'm going to be talking about. So, Halil is going to share with us a case that he dealt with, with a gentleman called Max. Thank you Halil.

[Background: Senior Rights Service 1800 424 079]

Halil: My name is Halil Ozbetazli, aged care advocate at Senior's Rights Service. Max was a client with early onset dementia and lived in an aged care home. As Max had difficulty communicating, his sister would often speak for him and make decisions for him, but not all of the sister's decisions were in line with Max's wishes. In particular, Max wanted to go on bus trips and have pocket money to spend on treats when he went out on the trips, but his sister would not allow this because of safety concerns.

The aged care manager contacted the advocacy service and suggested Max could benefit from the support of an independent advocate. Our advocate visited Max at the Aged Care Home, and asked Max if he would like the advocate support during a round table conversation between Max, Max's sister, and the aged care manager, which Max said he did. Our advocate attended and supported Max during the meeting, to enable him to make decisions about things that were important to him by asking Max yes/no questions. By framing questions in terms of a yes or no. With the support of our advocate, Max was able to communicate his wishes to the aged care manager and to his sister, including that he wanted to go on bus trips. And in the end, Max got to go on the bus trips with a special safety clamp fitting for his wheelchair. And he also got pocket money for his treats, so it was an overall positive outcome.

Margaret: Thanks, Halil, that was great. Let's look at enduring Power of Attorney and Enduring Guardian. Some people are very concerned about these roles because they think, “Oh dear, I don't want to give any of those powers because they're going to take over my life.” Let me assure you, an enduring guardian and a power of attorney shouldn't be taking control over you. The functions that they have are very limited. They just can't make willy-nilly decisions. There has to be a balance. They have to work in your best interests. They have to consider your wishes. They have to think about the things that you may enjoy.

In New South Wales, an Enduring Guardian and Power of Attorney are two different functions. It is different in other states, so it's very important that you understand that the differences. Halil and I work in New South Wales, and so, for us, we have to understand the powers of both of these guardianship and attorney ships. But basically, guardian makes decisions about health, and medical, and accommodation, and a power of attorney makes financial decisions. But the important thing that I want you to understand today is that, while you can make your own choices known, only you can make those decisions, you should be consulted. And if you can't make those decisions, then the guardian or attorney can step in.

There will be times when you've decided that you don't want to make the decisions yourself. And for example, the power of attorney with your finances. You may have a very large portfolio of shares and stocks that you, you're sick of playing the stock exchange with, and you're going to hand that over to someone. Or you just might simply be tired of paying all the bills, and you can't keep track of them. You can ask the power of attorney to do that for you. And of course, when you lose the ability to make your own choices known, then that's what the enduring guardian and the enduring power of attorney can do on your behalf. But remember, they shouldn't take over control, and when they make decisions, it should be a balanced decision based on your wishes and your interests.

Which then brings us to advocacy, which is the third part of our talk today. What is advocacy? Halil and I work for the Senior's Rights Service, which is part of the Older Person's Advocacy Network. And it's a network of services similar to ourselves, which covers the whole country, the whole of Australia.

There's a service like ours in each state, and I encourage you to use the resources that are linked to this webinar to find out which OPAN services in your state or territory. Basically, though, an advocate supports you. We're coming back to this supported decision making again, aren't we? And they support you by listening, by helping you to understand the issues that you may be concerned about, and then by assisting you, if you want us to, to sort that issue out or speak on your behalf.

Advocacy fits in with supported decision making. And once again, I'm going to get asked Halil to give a case study, an example of how an advocate can support you, and the role that an advocate does play.

Halil: Robert was a resident of an aged care home who was living with dementia. Robert contacted Senior's Rights Service because he was quite distressed about an incident that occurred involving another resident entering his room at night and switching on the light, which was quite stressful to him. An advocate spoke with Robert about the incident and provided support over the phone. With Robert's permission, the advocate got in touch with the manager of the aged care home and had a chat about what happened. The manager explained that the other resident, who also lived with dementia, accidentally entered Robert's room as he mistook it for his own room.

The manager also said that the care staff were working to ensure that that does not happen again, and were committed to making sure Robert's comfort and wellbeing are respected. The advocate explained this to Robert who was, in the end, quite thankful for being listened to, and was appreciative of the support being offered by the aged care home, and to make sure that that type of incident does not happen again.

Margaret: Thanks again, Halil. A really important part of being an advocate is to get the best for you. The best outcome, and the best for you in understanding what the issues are. One of the things that we do rely on heavily and all advocacy services use this is that the Charter of Aged Care Rights. There are 14 rights and many of them involve choice, decision making, involving you as a person in that decision making, keeping you informed, and keeping you in the centre of any decisions that are made while you have the ability to contribute and make those decisions. So, an advocate really does talk to you about being heard. It's important that you understand the role of an advocate. Not only do they support your rights, but they help you to be heard, very similar to supportive decision making. And Halil's going to give us another good example of how that is utilized, and how advocates work with people in aged care.

Halil: Petunia was a resident in an aged care home and had some memory loss. Petunia contacted us concerned that her clothes were stolen from her room, and felt that her repeated requests for the return of her clothes were being ignored. With Petunia’s permission, an advocate got in touch with the aged care home and spoke to the facility manager, who explained that the care staff had simply taken Petunia’s clothes to the laundry for washing, and that once they were finished washing, they would be returned to Petunia’s room.

Our advocate explained this to Petunia that the clothes were not stolen, but merely being washed, but acknowledged Petunia’s concerns and frustrations. In the end, Petunia was thankful for the advocate's support in helping to resolve the issue, and agree that she would reach out for assistance again in the future if needed.

Margaret: An advocate can also help you to educate those around you. An advocate can assist you by supporting your rights, and informing those who you are working with to understand your rights. Advocates go into aged care facilities, they talk to aged care staff, they talk to seniors’ groups all around the country. And basically, part of their education is ensuring that your voice is heard and that you are listened to, and that people understand that that is part of your right as an aged care recipient. Halil's going to give another case where this was very important to Thomas in his journey in aged care.

Halil: Thomas was a client we helped with his home care package. On one occasion, Thomas and his daughter were having a face-to-face discussion with a home care provider. During the conversation, the home care provider was only speaking to Thomas's daughter and not to Thomas. And this upset Thomas as he was perfectly capable of communicating and making his own decisions, and it left Thomas feeling as though he was not treated with dignity and respect. With the help of an advocate, Thomas' right to be treated with dignity and respect, and the right to be listened to were pressed, so that during future meetings, Thomas was actively involved in deciding about his home care which was an overall positive outcome that was favourable to Thomas.

Margaret: Thanks, Halil. Finally, I want you to know that there are three important things that we're getting across to you today. You are supported. There are services and people here who can support you, and you can ask to have that support. There are advocate services right around the country who can provide that service if you are an aged care recipient.

There are other advocacy services as well. And if you've got someone there to help you or you can do it yourself, it's a good idea to Google all sorts of different advocacy services because they are out there for you. And of course, an advocate's role is to help you, to educate those around you, that you do have the right to be consulted, and that's the most important thing – the right to be consulted, the right to be listened to, and the right to have a voice. It’s very important that you know that.

And finally, as part of the webinar, we have supplied different resources and that there'll be links to those resources. The Ready to Listen program is one that OPAN has put together, and it is really talking more about residential aged care or aged care services where that related to incidents and assaults in aged care, where often, the older person was just ignored, their voice wasn't listened to, they weren't even consulted. And this ‘Ready to Listen’ project is all about ensuring that the older person, doesn't matter what their capacity is, has the right to have a say and to explain what may have happened.

The supported decision making is just an overview, it's a document, it's an overview of what we've been talking about today, a lot more detail, of course, and it's worth a read. There is a link to the OPAN Advocacy services so you can find the advocacy service in your state. And finally, a copy of the Aged Care Charter of Rights. It's really important that you do know your rights, and of course, the most important right which is, or from our point of view, the right to have an advocate and have someone to speak for you, and that's what we're about today. So, thank you for listening.

[Title card: Together we can reshape the impact of dementia]

[Title card: Dementia Australia. 1800 100 500. Dementia.org.au]

[END of recorded material]

Communicating your wishes

Once you’ve made your decisions, tell the key people in your life, particularly those you’ve chosen as your decision-makers.

It can be difficult to talk to your loved ones about your future. You might be worried that you’ll upset them, or you might not know where to start. But talking about your plans helps your loved ones understand your values and choices, and gives them confidence when they’re making decisions for you later.

These are some tips to help you through the discussion:

Prepare for the conversation

Work out what you want to talk about. Writing down key points can help. If you’re unsure how the conversation will go, you could practise with someone else first.

Choose a time and place

Find a time when neither of you are distracted. Choose a place that’s quiet and relaxing.

Have an open and honest conversation

Raise the subject clearly and confidently. Explain why it’s important to you, and what will happen if you don’t discuss these issues.

Prepare for their reactions

Be prepared for them to disagree or feel upset. Expect silences and don’t offer reassurance too quickly, as this can shut discussion down. If they’re not comfortable talking, ask them if they’d like to discuss it later.

Decide on next steps together

Try to end the conversation with some practical outcomes. You might agree to talk in a week, for example, or they could read some information you’ve found for them. You might also follow up any issues with a doctor, financial adviser or lawyer.

You don’t need to have one detailed conversation where you discuss everything with your loved one. You might choose to have several small talks instead.

Documenting your decisions

Writing down your wishes makes sure there’s no doubt or disagreement about what you want later. You can do this informally by writing a letter or making a recording.

There are also legal documents that formalise your decisions and allow people to act on your behalf. There are some variations between different states and territories, but these are the key documents:

Advance Care Directive

This communicates your values, preferences and directions in relation to future healthcare and treatments. Advance Care Planning Australia provides more detailed information.

Enduring Power of Attorney

An Enduring Power of Attorney allows you to appoint one or more people to make financial or legal decisions for you. In some states, an Enduring Power of Attorney is also used to appoint a medical decision-maker.

Enduring Guardian (or Medical Treatment Decision-Maker)

This document allows you to appoint one or more people to make medical and healthcare decisions on your behalf.

Will

Your will sets out who will inherit your assets (such as your money or your house) after you die.

In addition, each state and territory provides detailed state-specific information and guidance on the different documents:

Our future planning webinar shares expert advice about these legal documents, including key considerations and possible issues.

Transcript

[Beginning of recorded material]

[Title card: Dementia Australia]

[Title card: Future Planning]

Sandra: Hello, and thank you very much for having me here today. My name is Sarah Breusch, and I'm a solicitor and clinical lecturer at the University of Newcastle Legal Centre. I'm coming to you today from the lands of the Awabakal and Worimi people in Newcastle, Australia, and I pay my respects to the Elders, past and present, and confirm that it's their lands that I'm on, delivering this talk today. I'm really pleased to be talking to you today about the general concept of planning ahead in a legal context, and what that might mean in your life, and what would be good for you to think about getting organised now.

I tend to start with this quote of saying, “It's not that I'm afraid to die, I just don't want to be there when it happens”, because I want to acknowledge that we are talking about some issues here that are often upsetting to contemplate. We all know we're going to die, but the concept of who we leave behind, and what happens, and what the lead up to dying might look like are things that are, sometimes, difficult to talk about, but in my practise, I end up talking about them a lot. And so, I just want to acknowledge that I'm not being glib about this, but they're issues that it's really better to address. And so, I suppose I've learnt to, in a sense, be comfortable in the space and say, “This is where we are and this is what we're talking about.” I practise a lot in what's called, generally, the elder law area, which is issues that arise for all of us as we age.

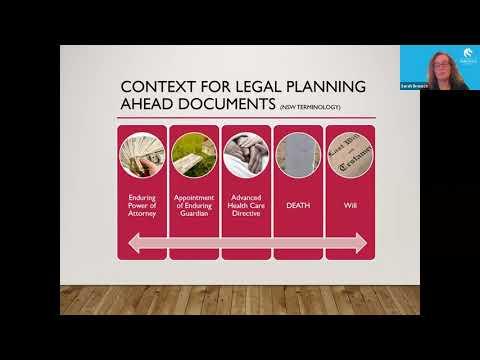

When we are thinking about planning ahead in this context, we're thinking about what sorts of things we want to try and get in place. Now, I'm from New South Wales, so I'm largely talking in terminology that relates to New South Wales, but please note that if you are in a different state or territory, these concepts all still apply, and there are documents that do the things we're talking about here, so this is just as relevant to you. Sometimes, the terminology varies a little bit between states and territories, but the concepts are all the same. We are looking here at the continuum of what documents are relevant, when. So, at the beginning, we have enduring power of attorney, an appointment of enduring guardian, an advanced healthcare directive, and these are all documents that might be relevant to you while you're still alive. We then effectively have a dividing line that is once you pass away, all those documents are no longer relevant, and instead, the only document that's really relevant then is your will and what that might be doing. So, they're the range of documents that we're going to go through and consider, in relation to the sorts of issues you should be thinking about.

So, we'll start with enduring power of attorney. An enduring power of attorney is where you appoint someone else who can make legal or financial decisions on your behalf. You can only appoint someone to be in this role while you've got mental capacity. Once you lose mental capacity, you can't make this appointment anymore. So you might think, “Oh, that's fine. My wife can get that for me when the time comes.” She can't. If the appointment is about you, you have to have the mental capacity to be making this appointment, to be signing the necessary documents, and a solicitor has to be satisfied that you're understanding those documents. When you appoint someone as your attorney, they can make these decisions for you. You may still actually have mental capacity to be making these decisions, but it might be that it's physically or mentally really difficult and too exhausting for you to be doing them, so you want this person to be able to be making the decisions now, but once it reaches a point where the principal, that is the person who's made the document, has lost capacity, that's when you really want an attorney, because at that point, you can't make these decisions for yourself, so you want to have someone appointed who you trust to make these decisions for you.

The law requires that that person is always acting in your best interests, you being the principal. They have to act in your best interests. As to when they can start acting, that will depend upon the particular document you've done, so when you consult a solicitor, which is what it would u sually be to produce an enduring power of attorney document, you can choose when it starts – do you want it to start straightaway? Because you might think, “Well, my daughter can already make these decisions for me, or my sister's already assisting this and I fully trust her, so I'm happy for it to start now.” Or you might think, “No, I only want it to start when I really can't make these decisions. When a doctor says I can't make those decisions, then that's the point at which I want that to begin.” So that's some of the decisions you need to make about this particular document when you have it.

The power of attorney document, itself, has to be in a specific form. All states and territories have a particular form that they recognise as being valid, and so you have to comply with that. And all states and territories require that the document be witnessed by a solicitor in order to ensure that it's being executed appropriately, and that it is your actual choice to be making the document. So, that's a sort of safeguard as to why we have a solicitor involved. There are extra powers that you can give the person you're appointing as your attorney at the time when you make this appointment. By way of example, we talk about the attorney can only be acting in your best interests, but let's say I've appointed my adult daughter to be my attorney, but my wife's still alive. It's just she's not very well, so I haven't appointed her, for one reason or another, and that's fine; but because my daughter, as my attorney, can only spend the money for my benefit, I probably want to include a clause in the document that says that my attorney can also spend the money for the benefit of my spouse. Or if I have a dependent child, or some other dependent person who is dependent upon me, I'd want that extra wording to be in the document to ensure that the money can be spent to maintain not just myself, but anyone else who I was already in an interdependent relationship with, if you like, financially.

Appointing someone as a power of attorney is a really powerful document. You are giving someone, effectively, access to all your money. The whole overriding principle is they must act in your best interests, but you need to think about a person you really trust to do this when you are contemplating getting this document. So, if we sort of take it to its worst, if you like, to think as seriously as we can about how much power we are giving someone, effectively, you are saying someone would have the power to sell your house, to have your dog put down, to sell all your blue-chip shares, and instead, invest in junk bonds, or something. So, this is an extreme example we appoint, really, just to help you be aware of the importance of picking the right person for the role.

So what can go wrong? We really hope it doesn't, but the reality is appointing the wrong person as your enduring power of attorney can enable elder abuse. It can enable someone to be withdrawing money from your account, and if they're not acting properly, they might be pocketing it themselves or spending it in some other way, so that's one of the ways in which it can go wrong. The other way in which it can go wrong comes back to this issue of who to appoint to this role. So, when we say it's the person you trust the most, it may well be your partner if you have a partner, or it could be adult children, it might be another family member, it could be a really good friend. If you appoint people jointly though, make sure they get along. So sometimes, I have people say, “Oh, I don't want to be seen to be playing favourites, and I have three kids, so I'm going to appoint all three of my kids together as attorneys.” Now on the face of it, that might be fine if they all get along, and they're close by, if it's necessary for them to be signing documents, physically going to the bank, things like that, that might work well. But let's say someone says, “Oh, my kids don't really get along, or these two don't,” I'd be saying don't appoint them to be attorneys together because you are kind of putting them in a situation where being in agreement is going to be essential, and that will really not go well if they don't get along.

Equally, you decide whether you're appointing them jointly. So that is they all must be taking active part in every single decision, or you might be appointing them jointly and severally. When they're appointed severally, that would allow any one of them to, act rather than all three having to agree. Now, when we think about contexts where this might be relevant, let's say it was a decision about selling your house, you very much would want all three of them to be involved in that because that's a really big decision. By contrast, let's say there was a conversation with Telstra about your phone bill. The idea of all three of them having to be on that phone call would probably be really annoying, so it might be, for that purpose, you want them appointed severally, that is to be able to act on their own. Again, we still come back to this idea though that, if they don't get along, don't appoint them together because it won't go well. Instead, pick one or two that will get along, but don't do multiple appointments where they don't get along.

Back to the idea of giving them the power to, say, sell a house. There is the possibility of making the appointments operate jointly for some purposes, but jointly and severally for other purposes. For example, you might say in decisions regarding amounts more than $5,000, I appoint my attorneys jointly, meaning to sell the house they would all have to agree. Whereas for decisions concerning less than $5,000, they're appointed jointly and severally, which will give them perhaps more practical ability to actually deal with these issues as they arise. I'm not expecting you to, right now, be automatically writing down everything you'd think you want, but these are just some of the issues you'd think of at that point of giving someone instructions to prepare a power of attorney document for you.

Now, as I said at the start of this, one of the critical details is that the person who's making the appointment has the mental capacity to be making that appointment, and that will be assessed by the solicitor who witnesses the document. What if someone has already lost mental capacity and they haven't made these appointments? What then? At this point, all states and territories have some version of a tribunal which can, in certain circumstances, appoint someone as a financial manager, or some other wording specific to that jurisdiction, who can make these sorts of decisions. So, it's like a court, if you like, a different level of court appointing someone to be your attorney. That's when you reach a point where something really isn't working, and there's a major problem that your family or your friends can't overcome, and therefore, it's become necessary to apply to the tribunal. I really don't suggest relying on that as a fallback, that's when it all goes wrong, that's where we end up, but that's ultimately what happens if someone has lost mental capacity but hadn't made the appointment. So, with the power of attorney, that's all about your financial and legal affairs. That's what we've been dealing with.

As we move on now to the other document we think of in this space, this is appointment of an Enduring Guardian. So, the last document, the attorney document was about your financial legal affairs, the Guardian document is about, really, everything else – what we think of as your lifestyle decisions. So, this is appointing someone to make lifestyle decisions on your behalf when you no longer have the capacity to make those decisions. Unlike the power of attorney document, in the Guardian document, you don't need to choose when it starts, it simply starts if you can't be making these decisions. You can't have a situation with the guardian document that you are still trying to make these decisions, and your guardian is, and there's an issue of there being some clash. That doesn't arise here because this only starts when you can't make the decision.

An appointment of enduring guardian, just like the attorney form, must be in a specific form in accordance with legislation in the state or territory you are in. It usually has to be witnessed by a solicitor, and sometimes, in some states and territories, the attorney and guardian documents are actually rolled into one. So, it's one document you are signing that will cover both of these kinds of issues, if you like. I guess that's a convenient point to explain to you that a lot of people will say, “Is there a problem in the appointing the same person as my attorney and my guardian?” And absolutely there isn't. There's no problem at all. You may well feel your spouse is the best person to be doing it, or you might feel your adult child is, or your friend is. What most of these documents allow for is an appointment in the alternative. So, I might say, “I'd like to appoint my husband in the first instance as my power of attorney and my enduring guardian, but in the document itself, there's a bit that can say in the event that my husband cannot act, is unable to act as my guardian or attorney, then I appoint such and such in the alternative.” And that might be where I go to my children, adult, they have to be adults, but my adult children, or I might then pick a friend, but that's a good thing to have, because I'm making these documents while I'm well, and I assume my husband will be able to do it, but what if he has suddenly passed away, or what if he, himself, has an illness that means he can no longer take on this role? I want to have someone else who can step in as the alternative. So, that's also something it's good to think about in this position of who to pick.

I should also say in relation to that idea of picking an alternative for both documents, that can be a way to overcome the issues of, perhaps, children who don't get along. That is rather than appointing them together, do one in the first instance. And if that one can't do it, then the other one does it in the second instance. If you are confident they will both act in your best interests, then they're appointed at separate points, if you like, in the chronology of what might happen, and therefore, it won't matter so much if they don't get along, because only one of them would be acting at a time. So, a solicitor also needs to help prepare those documents.

Other things we think about in terms of what you might put in an enduring guardian document, the usual powers that a guardian will have. Now, remember before I say what these are, that this is only operating when you cannot make these decisions for yourself. So, the usual powers the guardian has is they can decide what healthcare you receive, and they can decide where you live. So, if you've lost mental capacity, they will need to make the decision about whether you should be in a particular aged care facility.

The other kinds of limitations or conditions that we can put in that document, the enduring guardian document, is they can consent to medical treatment on your behalf, but they can also refuse medical treatment on your behalf, in certain circumstances. We think of this under that general term of do not resuscitate, and the wording in the form itself will be something to the effect of, “if I have an incurable illness, and I'm only being kept alive by artificial means, and doctors say there's no prospect of recovery, then I authorise my enduring guardian to refuse treatment on my behalf.” So, you can empower them to do that. You can also empower them, if you have particular beliefs around, for example, under no circumstances do I want a blood transfusion, or under no circumstances do I want an organ transplant, you can also include things like that in your limitations and conditions.

Something to bear in mind on the do not resuscitate idea, and whether or not you want to include that, is from my experience, one way to see that is you might be quite clear about that and go, “Oh, of course I don't want to be kept alive when things are that bad.” From my experience, it can be actually quite comforting to your family members if they're called upon to make that decision. Even though you may have told them that lots of times, the fact that the document actually has that written in it, can assist them at a time when they find it really hard to make that decision. They know what you wanted in their heart of hearts, but actually saying please end the treatment, knowing that will lead to your death is a difficult decision for them to make. And so, actually seeing it there in writing makes it a little bit easier for them to make that difficult decision. So, I would encourage you to think about if you take that view about your own healthcare, include it in the document, because I actually think you're doing a favour to those who have been called upon to make that decision for you.

The who to appoint decisions. Again, pick someone who you fully trust to make this decision, and who you trust to respect the choices you would've made. It's no problem, as I said, for it to be the same person as you appointed for the attorney. It may well be one and the same or it might be different people. I should just confirm that, within the medical system, the enduring guardian is often referred to as the next of kin or the person responsible. Next of kin is a term used in this space, it doesn't have strict legal standing, but if you had not appointed an enduring guardian, but there are records of who you've identified as your next of kin, then that person will usually be regarded as having sort of enduring guardian-type power, and the ability to make those decisions for you. What I would suggest is that you don't end up with a situation where you've appointed one child as your enduring guardian, but when you go to hospital you routinely write down a different child as the next of kin. Don't do that. Keep it consistent to avoid there being issues that arise of, potentially, a dispute between two different people.

Now, that sort of leads to the bottom point there, and that is what if there is a point where you have, let's say I have a partner who's not the parent of my children, and I also have adult children appointed as my guardian, and let's say there's a dispute between them as to what healthcare I should still be receiving. If that dispute can't be resolved between them, then ultimately, they apply to the civil and administrative of tribunal for it in New South Wales, or the other equivalent tribunal in other states and territories, and that tribunal can resolve the dispute. We hope it doesn't come to that, but that is ultimately what's available if it does.

When we think about these documents, generally, it’s critical to remember you can only make these documents while someone still has mental capacity. It's important to realise that just because someone has been diagnosed with dementia does not mean, automatically, they can't make these documents anymore. That will be an assessment by a solicitor who needs to sign off on the documents about whether the person still has the necessary mental capacity to understand what these documents do, and if the solicitor can be satisfied of that, the documents can be done. If they're not satisfied, then you would end up trying to work around without having them, and if necessary, applying to the tribunal to get them. The types of areas where we might see difficulty or issues arising. So, the power of attorney can be useful even if, mentally, I'm still okay to do this stuff, but if physically going to the chemist is becoming difficult, or going to the post office to pay my bills is becoming difficult, I might find it really useful to have someone appointed as an attorney.

The intrafamily conflict, I've just alluded to that that can arise and so just think about making appointments as far as you can to avoid those conflicts arising. Gold digging family. So, what we'd say is appointing someone who is in financial difficulty, and might be tempted by having access to your money is not probably a great idea. So, just be aware of that, and that can be an area where we see people trying to apply to the tribunal to have an attorney removed, where the attorney is not seen to be acting in the best interest of the person.

Sometimes, some people say, “I don't have any close family who I trust, or I don't have any close friends who I trust.” If there really is no one you trust, then you can talk to your doctor, or that's when, particularly, you might want to think about doing these sort of advanced care directives, which we're going to talk about next, to look at having someone, or having your wishes recorded in a way that means that medical staff will know what you would or wouldn't have wanted to have happened. So what I suggest, to get these documents done, is that you see a solicitor, or the trustee and guardian, which is also called the public trustee in different states and territories, to look at getting those documents done.

The last document, and this one's a little bit different, but I want to talk about in this space is an advanced care directive. This isn't a prescribed legal form, so what I mean by that is it doesn't have strict wording it has to comply with, but it's a concept that's recognised by the law, and supported by the law in all states and territories. This is a document that you complete regarding your future healthcare, and it's a way of you having some say in what healthcare you would and wouldn't want to receive, at a point when you had lost the ability to explain what you would want to happen, or even to be aware of perhaps what's happening to you in a healthcare context. So, what this document aims to record is what your values are in terms of the healthcare you receive, and what your goals are, and what's important to you.

This document has some overlap with the enduring guardian document. For some people, they might say, “No, I really don't feel I need an advanced care directive. I'm really confident that my enduring guardian will be able to make these decisions when the time comes”, but let me just give you an example of where I've helped people where they, in fact, decide they want both documents. Sometimes, when someone's been diagnosed with a particular illness, they can see, looking forward, that that illness will ultimately lead to their death, and the doctors are able to say to them, “These are the steps that are likely to happen in that journey towards your death.” They may then have particular ideas about, “Oh, if I'm only being kept alive by a machine, I don't want that to happen.” So, particularly where you know what illness it is, there may be particular aspects of the treatment, and the course of that illness that you have particular strong feelings about.

I had a client who had motor neuron disease, and she was single but she had one son who was 21 years old. She had appointed him as her enduring guardian, but with what I think was a lot of forethought, and a lot of parental knowledge of the situation in which her son was going to find himself, she had included a “do not resuscitate” clause in that enduring guardian document saying, “Once I get to a certain point, I don't want to be kept alive. I'd rather just let nature take its course, and I'd rather be allowed to die.” She knew though, as a 21, 22-year-old son, him making that decision would be really difficult for him. For that reason, she did quite a detailed advanced care directive with her doctor, in which she was able to anticipate, knowing she had motor neuron disease, these were the likely things that she would end up needing medical interventions for. And so, she made a clear advanced care directive that stated, “If I'm needing this, then this is what I do and don't want in terms of treatment. If I need that, then that's the same.”

The classic would be, for her, she said, “If I suffer a cardiac arrest, I do not want to be revived, I just want to be allowed to go.” By this point, she was already in a wheelchair, and she felt her quality of life was really declining substantially. By doing the advanced care directive, it wasn't that she didn't trust her son, but she wanted to minimise the difficult decisions he would be making around her choices. So that's why she did the advanced care directive, to make it clear to all her treating doctors what she wanted and didn't want, to really to try to ease the burden from her son at that difficult time. So, really, what an advanced care directive does, it assists those around you to know what you did or did not want at the end-of-life healthcare decision stage. This is not a document a solicitor has to do. Usually, it's done in a medical context. So, for example, health departments often will have a fairly standard form that they might give you to talk to you about this once you've been given a diagnosis of something that's likely to be terminal. Some of these documents are really short, some are very long and detailed. They are all respected by the courts, and that's kind of important to note.

So, they're the three documents you might want to think about having. As we said about the advanced care directive, you may decide that you've got a guardian, and enduring guardian, and you don't need the advanced care directive, or you may decide you want both, but they're kind of all the documents that operate in this space. I should have also said the advanced care directive is also sometimes known as an advanced healthcare directive. So, it sort of has slightly different names, and they're all respected by the courts, but they may just have different wording in different states.

All right, so now we're reaching the kind of threshold point where you pass away, and you've died. Really important to note at the time you die, the appointment of power of attorney and enduring guardian no longer has any legal effect. This is important because I sometimes have people say to me, “I don't need a will. My power of attorney can deal with all that when I die.” And the answer is, “No, they can't”. As soon as you die, the appointment of the power of attorney, and the appointment of the enduring guardian no longer have any legal effect. So that's the threshold point. So, this is where we then come to the importance of having a will.

I can talk for hours about situations I've seen of where it goes wrong when people don't have a will. Approximately 60% of adult Australians have a will, but that means about 40% of adult Australians don't have a will. If you die without a will, then there's legislation in each Australian state and territory that will determine the order of inheritance of whatever you own. That order of inheritance is pretty much inflexible, it's strict, it's inflexible, it just applies certain rules and, really, without any particular regard to what you might have said you wanted, or what your family understood, it just has this strict set of rules that applies. So, let me give you some examples. This is a bit like a bit where I try to scare you into why you should have a will. Let me give you some examples of when not having a will doesn't go well.

If you have separated from a spouse to whom you are married but you are not yet divorced, the law does not have any respect for the fact that you are separated. It just says, “Did you leave a spouse? Yes.” And so, in New South Wales, for example, let's say I was married to someone who is not a parent of my children, and at the time I die, I don't have a will. Under New South Wales law, my spouse will get a statutory legacy amount which is worked out by a formula. At the moment, that's about $470,000, that they'll get the first $470,000 of my estate, and everything beyond that divides in half. Half also goes to that spouse. The other half divides equally between all my children. So, you can see, imagine I've been separated. I think, “Oh, I've got nothing to do with my husband anymore,” but I haven't actually got divorced, you can see that's ringing about an outcome that's really not great.

Another example of where this doesn't go well, I've had a number of clients come to me where they've been in a long-term de facto relationship, maybe 10, 12 years, and their partner owns the house that they live in, and the partner then dies without a will. Some of these de facto couples then end up in dispute with the partner's children, who are not my client's children as well. And my client says, “Yes, we were in this de facto relationship, I should be recognised as a spouse.” Now, the law can recognise a de facto spouse, but sometimes, these people were not partners for Centrelink purposes. So, turning around suddenly and saying, “Oh actually, we are partners”, then runs the risk of, obviously, it looks like you've been defrauding the commonwealth by having single Centrelink pensions for an extended period, and, of course, the adult children who want to inherit the estate if there is no de facto spouse are very keen to say, “Centrelink didn't think you were a couple.” So you can see this creates really awful situations where, often, the left behind partner is at substantial risk of being kicked out of that house, because they may not be recognised as the de facto partner of the deceased.

Children of previous relationships, so that sort of comes from the same thing that is, all right, let's go with another scenario: let's say I am in a married or de facto partnership with my new partner, I have children who are not from that relationship, and I die owning about $400,000 worth of assets. Then, the law in New South Wales will say, “Based upon how it works, okay, your children don't get anything, it all goes to your partner.” Whereas, perhaps, if I'd thought about doing a will, I may have actually thought, “Oh no, I want my children to get this, or I want to try and do this fairly, but this is my view on what I want.” So, you can see it just takes away choices that you might have otherwise had.

Now, often people will ask me, what about doing a will with a will kit, which can be brought from a news agency? Now, there's nothing, or online, I think that can be brought as well. If you are very good at following instructions, you are very good at thinking through exactly what you want and exactly how that will work out, and you are good at even thinking about how the drafting might work, and you follow the will kit exactly, the will kit may well go, okay; but I have to tell you that I see, so many times, when will kits don't go well. What I'd probably suggest to you is if you are talking about leaving assets of thousands of dollars, often tens of thousands, hundreds of thousands of dollars to people, the benefit of paying a solicitor maybe $500, maybe $800, to draft a will compared to the value of the assets you are leaving. Usually, I would say to you, “That's money well spent to make sure this is done properly”. Because a will kit may go okay, but if it doesn't, the consequences can be pretty bad for the people you've left behind.

So, let's assume I've now talked you into getting a will. Things to think about before you get a will. What's the executor and who should you choose? So, the executor is the person appointed under a will, whose job it is strictly to arrange your funeral, or to delegate to other people to arrange your funeral. If there's a dispute about whether your body is to be cremated or buried, they're the person who has the actual decision to decide that. But then, beyond those immediate things after you've passed away, their job is to identify what assets you own, any debts you may have, they need to deal with all the assets, pay any debts, and distribute your estate in accordance with the will. So, who should you choose? Don't pick someone who's likely to come into dispute with the estate. Pick someone who is likely to be reasonably organised, get on with it, and be prepared to do the work involved.

There's a bit of a misunderstanding that, sometimes, people think they should pick, as an executor, someone who's not mentioned in the will. In fact, usually, we would say pick someone who is getting a benefit from the will, because that gives them the incentive to do what is quite a bit of running around and paperwork, to actually get the job done of the executor. So, pick someone who will get something from the will because there's incentive for them to do it. You can appoint more than one executor, so you might appoint all your children. Again, don't do it if they don't get along. Don't appoint executors who are likely to come into dispute with the estate, or joint executors who will not be able to get along and do the job. And if you've got six kids, probably appointing all six might be quite problematic, because that's a lot of people having to get together to sign the documents and things.

Moving on from the role of executor, when you think about how you're giving your estate away, can I just suggest as a general thing, not to approach this as asset by asset. So don't think, “I'm going to give my house to my two children. I'm going to give my car to my sister, and I'm going to give all my artworks to my brother, or something like that.” Or to put in a more extreme example, I had a client who had four children, and he owned four houses at the time he did his will, so he decided to leave one house to each child. The problem came that once he had died, my client came to me, and the house that which she had been left under the will had already been sold. What that meant was she got nothing from the will. So that would be the reason if that client had consulted me, I would've said to him, “Just leave the whole estate to be divided equally between your four children. If they want to negotiate with each other, “Oh, I'm going to keep this house so it's worth that much.” That's fine, let them do that. But the risk, always, with leaving a particular asset to someone is that you may not own that asset at the time you die.”

Often, when I say this to people, they say, “But I'm not selling my house.” Well, you don't know if by the end of your life, you have not been able to live in your house for a long time and you've been in an aged care facility, you may well not own your house. You didn't anticipate that happening, but it might be the case. So, for that reason, it's better to give away your estate, under the will, by saying half to these two people, half each, or divided equally between, or something like that, rather than the asset-by-asset idea.

This bit's painful for people to think about, but it's important to think beyond just one or two beneficiaries. So, say someone says to me, “I'm single, I just want to leave everything to my daughter,” I will always say to them, “If something were to happen to your daughter, what do you want to happen to her share? Do you want it to go to her children if she has any?” And they might say, “Oh yes, that'd be good. She doesn't have any children at the moment.” Okay, that's fine, we can draft the will saying it goes to her. If she's already passed away, it goes to her children, if she didn't have any children, who do you want it to go to then? Because if you don't do that then, and let's say all the beneficiaries named in your will have not still been alive at the time you die, then you'll be back with those quite inflexible rules of intestacy, which is as if you didn't have a will. So, for that reason, it's a good idea to think forward. What if this, what if that, and try and come up with different scenarios. I often describe to people, it's like I'm telling them about horrendous catastrophic events which most of us don't want to think about, but it is important to think “what happens if.”

In my own situation, I have four children and so, for me I say, “What if the plane crashes, and it's my husband, and I, and our four kids all in the plane? What do we then want to happen to our estates at that point?” Just briefly to mention, it's important to think about superannuation in this space as well, and realise that superannuation usually does not form part of your estate. It is determined who it goes to by what you have filled in terms of binding or non-binding nomination of beneficiaries. I won't go into that too much more, but just be aware of super as being a large asset, which strictly doesn't get dealt with by your will, but is still a really substantial asset to think about.

A lot of you may already have a will and that's fantastic. Important just to, every now and then, go back, revisit it, and think, “Does it still do what I want it to do? Have any of the named beneficiaries died?” They might have and the will still works, but has in fact that changed the situation. Have there been marriage breakdowns that have changed the situation or relationship breakdowns? Just go back, revisit it, see if it still does what you want it to do. My final note there about, remember, making a will does not bring on death. I say this because a lot of people have a bit of a mental block to making a will. Somehow feeling like, by making a will, I'm going to die sooner, and there's nothing in my experience that suggests that's the case, but that's my little bit of reassurance for you.

Well, hopefully I haven't bamboozled you there with too much information, but what I'd suggest you do if you are interested in getting these documents is contact your local solicitor. Often, people say, “Oh, who should I see? If you've seen a solicitor to buy or sell a house, that's probably a good starting point. Try and see someone who does a decent amount of work in this area of wills, and power of attorney, and enduring guardian documents, because you want someone who really is attuned to the issues. You can also contact the public trustee or the Trustee and Guardian, they do charge fees. So, it's important to be aware that you will incur fees either way, but that's another possibility. And you could always contact the National Dementia Australia helpline as a starting point on 1800 100 500. Thank you very much for joining me today.

[Title card: Together we can reshape the impact of dementia]

[Title card: Dementia Australia. 1800 100 500. Dementia.org.au]

[END of recorded material]

Reviewing your plans

“Planning ahead” doesn’t just happen once. It’s more like a series of discussions and actions over time. Things change, and you’re free to alter your plans or decisions whenever you want.

Review your plans regularly to make sure they’re up-to-date and still reflect your wishes. You should also review your plans if:

- you’re diagnosed with a new health condition

- your health deteriorates or you’re less able to live independently

- your support structures change (for example, if your partner or carer dies)

- someone who was going to be your substitute decision-maker isn’t able to do this anymore.

The National Dementia Helpline

Free and confidential, the National Dementia Helpline, 1800 100 500, provides expert information, advice and support, 24 hours a day, seven days a week, 365 days a year. No issue too big, no question too small.